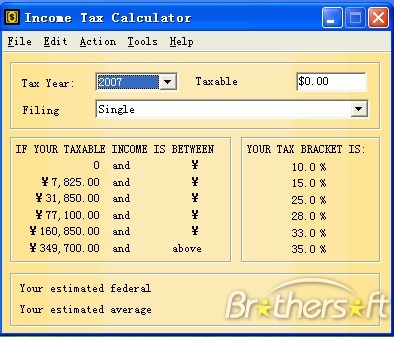

The tax calculator or tax estimator does not store any information and is not intended to manually file (mail in) or electronically file ( efile ) your tax return with the Internal Revenue Service (IRS). As soon as you have entered the most important tax information, the tax calculator will provide you with a tax estimate. Want to see how much money you can receive from the IRS? Easily file federal and state income tax returns with 1 accuracy to get your maximum tax refund guaranteed.

Start for free today and join the millions who file with TurboTax.

Our tax return calculator will estimate your refund and account for which credits are refundable and which are nonrefundable. Because tax rules change from year to year, your tax refund might change even if your salary and deductions don’t change. See Tax Payment Options if you need to make an estimated or additional tax payment.

Four electronic filing options for individual taxpayers are listed below. For businesses and other taxpayer audiences, see the links to the left. Use IRS Free File or Fillable Forms Use IRS Free File if your adjusted gross income is $60or less.

If you are comfortable doing your own taxes, try. Accurately estimate your tax refund for free using the TurboTax Tax Refund Calculator.

This tax calculator is solely an estimation tool and should only be used to estimate your tax liability or refund. It should not be used for any other purpose, such as preparing a federal income tax return, or to estimate anything other than your own personal tax liability. Your upload time will depend on your connection speed and other situational factors.

Estimating file upload speed. Maximum refund and 1 accuracy guaranteed. In addition to our tax return estimator , we offer a variety of resources for calculating your taxes and getting the refund you deserve.

Sign in to your TaxAct Account here. TaxSlayer is the easiest way to file your federal and state taxes online. Learn about our tax preparation services and receive your maximum refund today.

We provide authorized IRS e-File software to help file your tax return. TaxStimate tax calculator is a handy little tax liability estimator , though it comes with no guarantees. PLEASE NOTE: If the homestead deduction is selecte this tax bill estimator assumes that 1 of the entered assessed value is eligible for the homestead deduction and credits.

Indiana law states that only the value of the primary residence, plus a maximum of one (1) acre of lan is eligible for the homestead deduction and applicable credits. Using free tax calculators is an easy way to estimate your tax return. Don’t let tax reform catch you by surprise this tax season – see what’s in store for your return.

Taxpayers who estimate they will owe $2or more in tax on income not subject to withholding must pay estimated tax.

When the annual income tax return is file the prepaid estimated tax is credited against the actual tax liability. It’s never been easier to calculate how much you may owe or get back with our free tax estimator tool. Enter your tax information to the best of your knowledge.

As you make progress, the taxes you owe or the refund you can expect to receive will be calculated and displayed on each page. Login to your MyTurboTax account to start, continue, or amend a tax return, get a copy of a past tax return, or check the e-file and tax refund status. Efile your tax return directly to the IRS. Prepare federal and state income taxes online.

Looking for an easy, low-cost way to prepare and e-file your tax returns? HR Block offers a wide range of tax preparation services to help you get your maximum refund. Need help with tax preparation?

E Smart Tax guarantees the biggest refund with our free online tax filing. E-file your federal and state tax returns with confidence and ease. I will tell you what it cost me. NEVER using Turbo Tax again.

State return and another $19. I can hire an accountant cheaper than that. File - file Form NC-and your estimated tax payments using a tax professional or commercial tax preparation software (see list of approved eFile vendors).

Using eFile allows you to file federal and state forms at the same time or separately, and schedule payments as far in advance as months. Free eFile is available for those who qualify. Pay individual estimated income tax. Use eFile to schedule payments for the entire year.

What is individual estimated income tax ? Individual estimated income tax : Income tax you expect to owe for the year. The Ohio Department of Taxation provides the collection and administration of most state taxes, several local taxes and the oversight of real property taxation in Ohio. The department also distributes revenue to local governments, libraries and school districts.

Did you withhold enough in taxes this past year? Use this calculator to help determine whether you might receive a tax refund or still owe additional money to the IRS. Remember this is just a tax estimator so you should file a proper tax return to get exact figures.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.